Canadian policymakers are closely monitoring rising household debt, particularly in the context of elevated house prices, inflation, and higher interest rates, which pose risks to financial stability. While debt can be a tool for wealth accumulation, the current environment has made it riskier, especially for those with high loan balances.

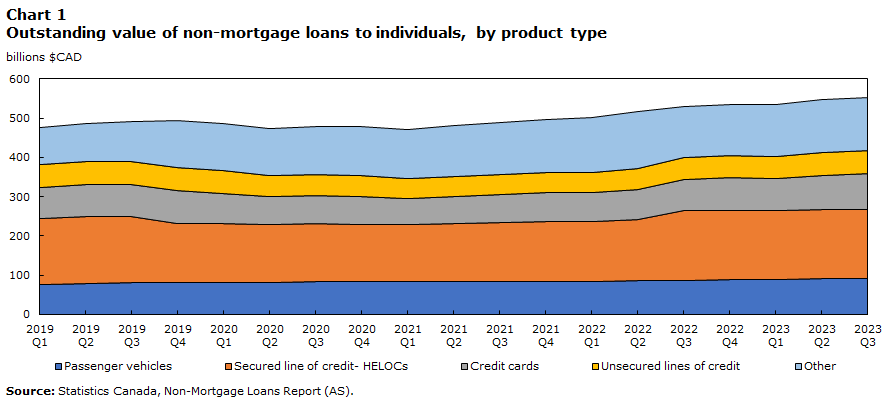

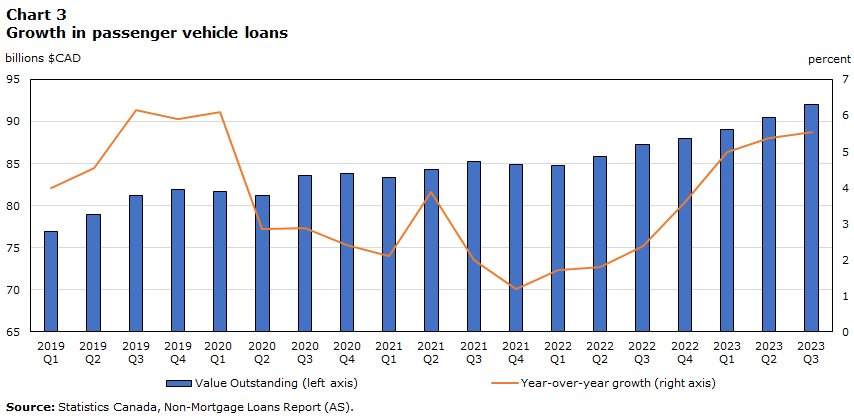

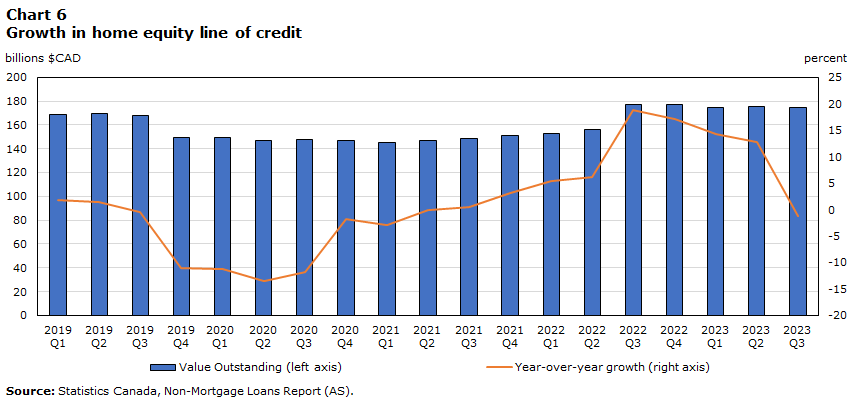

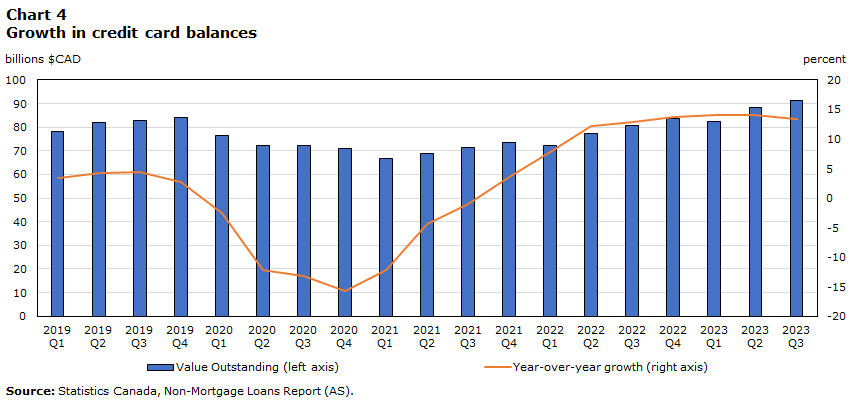

Non-mortgage loans have surged since the pandemic, driven by consumer goods, vehicle loans, and lines of credit. Despite initial declines during lockdowns, these loans reached $553.1 billion by Q3 2023, reflecting a 13.7% increase from Q1 2020. Inflation and higher interest rates have pressured Canadians, leading to increased borrowing costs and higher debt levels.

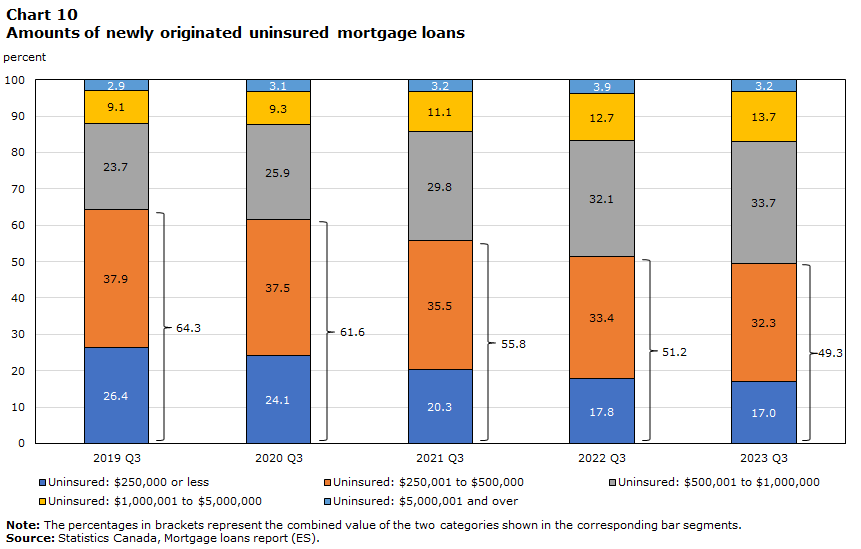

Mortgage debt, which accounts for about 70% of total loans, also saw significant changes. Uninsured mortgages have grown faster than insured ones, driven by rising house prices and regulatory constraints. By Q3 2023, uninsured mortgages were prevalent in major urban centers where housing prices remained high.

Rising interest rates have also led to changes in mortgage terms, with many borrowers facing longer amortization periods and higher payments as they hit trigger rates on variable-rate mortgages. The analysis underscores the growing financial burden on Canadian households and highlights the importance of understanding the implications of both mortgage and non-mortgage debt in maintaining financial stability.

Source:

https://www150.statcan.gc.ca/n1/pub/11-621-m/11-621-m2024009-eng.htm