Leading the Way in Business and Community

Photo Credit: Niagara Falls Innovation Hub & Airbus Helicopters Canada

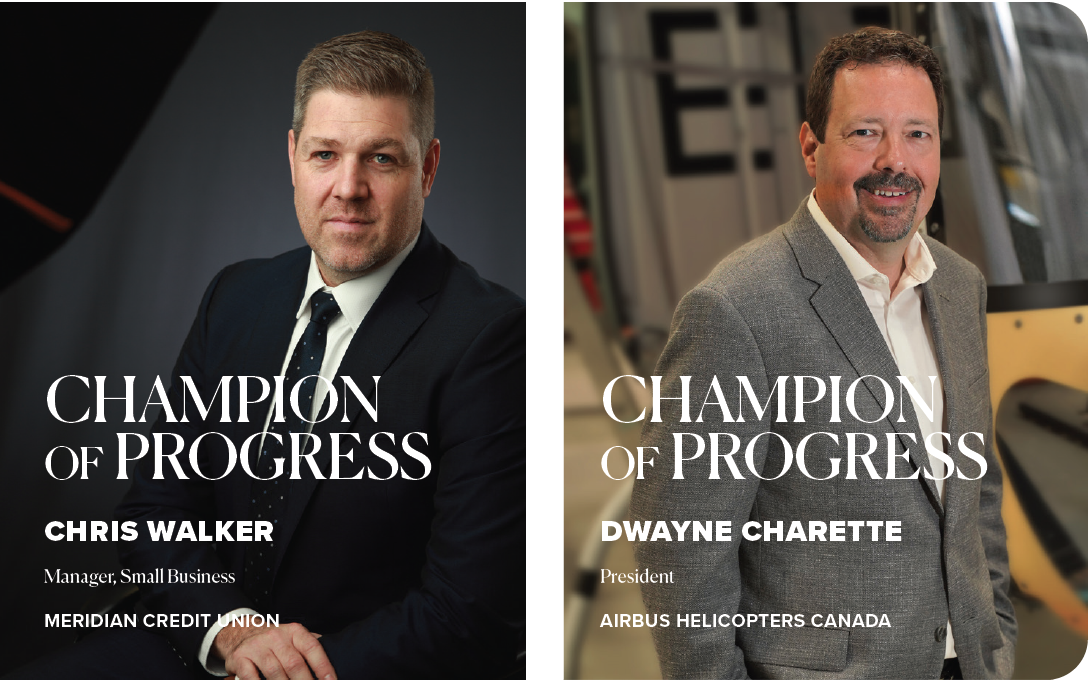

Top, left to right: Dean Spironello (Economic Development Officer | Business Development | City of Niagara Falls); Chris Walker (Manager, Small Business Niagara & Hamilton, Meridian Credit Union); Hon. Nina Tang, Associate Minister for Small Business (Ministry of Economic Development, Job Creation and Trade); Emma Eldon, Marketing & PR Manager (Niagara Falls Innovation Hub) | Below, left to right: Andy Wilcox, President, Heli-1; Dwayne Charette, President and COO, Airbus Helicopters Canada; Trent Lemke, President, Ascent Helicopters; Wayne Woytkiw, Regional Sales Manager, Alaska, Hawaii & Western Canada, Airbus Helicopters North America.

ESG stands as the new benchmark for corporate excellence, encapsulating a firm's commitment to environmental stewardship, social responsibility, and ethical governance. Chris and Dwayne exemplify the embodiment of these values. Their leadership showcases how integrating ESG principles is not just about meeting a checklist of good deeds but about embedding these core values into the very DNA of their operations.

With a staggering 87% of consumers ready to shift allegiance to companies that prioritize ethical practices, including how they handle data and their broader corporate responsibilities, the message is clear: the public and investors alike are watching.[1] 73% of investors consider a company's environmental and societal contributions as key factors in their investment decisions. This convergence of consumer and investor priorities highlights Niagara as a fertile ground for businesses committed to the ESG ethos, underscoring the economic imperative to weave these principles seamlessly into business strategies.

Yet, the path to becoming a beacon of corporate responsibility is laden with hurdles, including bridging the trust gap highlighted by a PwC study, which shows a disconnect between executive beliefs and consumer trust.[2]This gap points to the necessity for businesses to not only pledge their allegiance to ESG values but to also enact tangible, impactful actions that resonate with both customers and society at large.

Leaders like Chris and Dwayne, through open dialogue and commitment to ESG principles, bridge the trust gap and pave the way for a new era of business excellence. In doing so, they position Niagara as not only a place of natural beauty but also as a model for thriving businesses in a sustainable, inclusive, and ethical environment.

The overall narrative is clear: businesses that embrace and transparently act on ESG initiatives will not only align with the evolving societal values but will also lead the vanguard of a sustainable and equitable global economy. [3]

Chris and Dwayne, through exemplary leadership and action within their communities, are examples of illuminating the path forward, showing that the future belongs to those who embrace the principles of responsibility, sustainability, and inclusivity as the cornerstones of their operations.

Socially Responsible Investing at Meridian

Chris, reflecting on Meridian's approach to responsible investing, stated, "Our commitment to responsible investing is more than just a policy; it's a reflection of our core values and our dedication to positive change. With 90% of our full-time Financial Advisors achieving the Responsible Investment Specialist (RIS) designation, we're equipping our team with the knowledge and skills to guide our members towards investments that not only yield financial returns but also contribute positively to society and the environment". This strategic focus ensures that investments align with ESG criteria, reinforcing Meridian's role as a leader in ethical financial services.

Meridian Credit Union's strategy in responsible investing and its overarching corporate responsibility objectives are a testament to its commitment to fostering sustainability, diversity, and inclusion within the financial sector. The institution's integration of socially responsible investing (SRI) practices and the implementation of the "Meridian for Good" initiative underscores a holistic approach to ethical banking and investment that prioritizes both member welfare and community impact.

The "Meridian for Good" strategy, as described by Chris, "represents our blueprint for making a meaningful difference in the lives of our members and the broader community. It's about leveraging our role as a trusted financial partner to drive inclusivity, transparency, and sustainability across all our operations". This initiative is a bold step towards integrating financial services with social responsibility, aiming to enhance financial literacy and access, particularly among equity-deserving communities, thereby fostering a more inclusive financial landscape.

Meridian's approach to governance and ESG integration is uniquely driven by its commitment to its members and the broader societal good. "Our governance model, centred around our credit union ethos, ensures that our members' voices are heard and that their interests are at the heart of our decision-making processes. This democratic approach is vital in embedding ESG principles into our strategy, ensuring that we remain accountable and transparent in all our endeavours," Chris elaborates. This member-focused model underscores the importance of ethical considerations in financial decision-making, setting Meridian apart from conventional financial institutions.

Chris’s insights highlight the depth of Meridian's commitment to these values, showcasing a forward-thinking approach to banking that prioritizes ethical and sustainable growth. As the financial industry continues to evolve, Meridian's integrated approach to ESG and responsible investing serves as a model for others in the sector, demonstrating the potential for financial services to contribute positively to global challenges.

Airbus' Pioneering Sustainability Efforts

“Our facility is ISO 14001 certified which speaks to our commitment to improving our environmental performance (. . .) Airbus additionally has our High5+ program, which aims to influence a significant reduction of our environmental footprint in manufacturing activities, by 2030.” Dwayne shared, also highlighting that CO2, energy, water, air emissions and waste are the five environmental materials that are covered under Airbus’ reduction plan.

Airbus' achievement of ISO 14001 certification across its operations demonstrates a structured approach to environmental management, ensuring continuous improvement and compliance with globally recognized standards. ISO 14001 is an international standard for environmental management systems (EMS). It outlines requirements for organizations to establish, implement, maintain, and continually improve environmental performance. It helps businesses reduce their environmental impact, comply with regulations, improve efficiency, and enhance their reputation.[4]

The High5+ program, aiming for significant reductions in CO2 emissions, waste, and water usage by 2030, positions Airbus as a frontrunner in sustainability efforts within the aerospace industry. This initiative showcases the company's commitment to setting and surpassing ambitious environmental goals.

Airbus' focus on Sustainable Aviation Fuel (SAF) is particularly noteworthy. SAF is identified as a key driver for decarbonizing the aviation sector, capable of reducing lifecycle CO2 emissions by up to 80% compared to conventional jet fuels. Airbus has committed to enabling 100% SAF capability across its fleet by 2030, marking a significant step towards achieving net-zero carbon emissions by 2050. [5]

Airbus has officially committed to defining science-based targets for all its emissions, with near-term targets submitted to the Science Based Targets initiative (SBTi) and validated in early 2023. These targets include a 63% reduction in Scope 1 and 2 emissions and a 46% reduction in Scope 3 emissions intensity by 2035, using 2015 as a baseline.

Dwayne also highlights that "Today, all Airbus aircraft and helicopters are capable of flying with up to a 50% blend of SAF. SAF can reduce life cycle CO2 emissions by up to 80% compared to conventional jet fuel. Airbus is actively testing 100% SAF capabilities on many aircraft, including the H225 helicopter. Airbus is additionally investing in hydrogen, through the ZEROe program that explores configurations and technologies, and pursuing hybridization as a way to improve aircraft performance and reduce fuel consumption.”

Since 2011, SAF has powered more than 450,000 commercial flights globally, although it still represents a small fraction of total fuel use. Airbus supports the large-scale development of the SAF ecosystem to meet the industry's net-zero aspirations.[6]

Airbus' sustainability endeavours, supported by recent statistics and initiatives, reflect a deep-seated commitment to environmental responsibility and innovation. Airbus not only leads by example but also drives the broader aerospace industry towards a more sustainable and prosperous future.

The Impact of ESG on Business and Society

The integration of ESG criteria into business practices has become a significant focus for corporations aiming to enhance their sustainability performance. The broader implications of ESG on corporate performance, societal well-being, and the environment are profound.

Research indicates that adherence to ESG criteria can offer competitive advantages, challenging the notion that ESG considerations are merely cost factors. Companies that integrate ESG criteria into their operations can differentiate themselves in the market, potentially leading to better financial performance and sustainability outcomes.[7] However, the relationship between ESG performance and financial outcomes is complex. While some studies suggest a positive correlation between ESG-focused investment funds and market outperformance, other analyses highlight the variability and context-dependence of these relationships. This underscores the need for a nuanced understanding of how ESG factors contribute to corporate value, beyond simplistic causative assumptions.[8]

The Greater Niagara Chamber of Commerce has underscored the critical role of ESG frameworks for modern businesses. With global ESG investment anticipated to hit $33.9 trillion by 2026, adopting ESG principles not only showcases a company's commitment to corporate responsibility but also significantly boosts its appeal to investors and talent. This trend reflects a broader movement towards integrating ESG strategies into business models to navigate environmental, social, and governance challenges effectively.[9]

Niagara's champions lead an evolutionary shift toward corporate responsibility and environmental stewardship. Their unwavering commitment to ESG principles paves the way for sustainable growth and inspires a collective movement toward a more equitable, environmentally conscious future. Leaders like Chris Walker and Dwayne Charette show that true success lies not in mere financial gains but in the positive impact on our planet and its inhabitants. The legacy of these organizations and their leaders will undoubtedly shape Niagara's business landscape, proving that integrity, sustainability, and social responsibility are the most valuable currencies in the quest for progress.

Originally published on Reveal Niagara Magazine | Vol 5 Iss 1 (March 2024)